Ask David: How Do I Create Retirement Strategies?

When you’re looking toward retirement, there are plenty of considerations to make as you put investment strategies into motion. You, like many investors, are probably interested in learning how to make smart moves today in the hopes of building a solid nest egg for tomorrow.

But what are some ways to strategize for retirement?

Today, we’re talking to our very own David Hemler, MS, MPAS, CFP to learn more about some of the most important factors to consider when planning your retirement income.

Take Your Lifestyle Needs into Account

Before you plot a course for retirement investing, it’s important to consider your lifestyle, both your present preferences and what you anticipate your future to look like. If you’re married and plan to retire, you also need to take into consideration your spouse’s preferences when factoring your future cash flow needs.

For example, if you and your spouse enjoy activities with different cost factors, you need to reconcile the differences and make a plan that accommodates your combined ideal lifestyle. Additionally, you want to factor in your anticipated health and activity levels, as well as the length you desire your retirement to be.

Once you have these parameters in place, you can start to put together a plan that encompasses the future period of time that is “your retirement”. Factors like average costs of living can be a general guide, but the cost of funding your lifestyle is an important way to figure your retirement needs.

Start Investing as Early as Possible

The ideal time to start investing in your retirement is as soon as you start to earn income. For a majority of earners, this would put the beginning of retirement savings in their teens or early twenties. But even if this doesn’t apply to your situation, it’s never too late to start putting money aside for your retirement needs.

There are two factors that play into your retirement savings planning. The first is the amount of money you need to save, or your capital needs planning goals. The second is the compounding power of the money you’ve already set aside. When you have funds set aside from your first job or two -even a small amount -, that money can potentially earn more over decades of your career and put you closer to your goals.

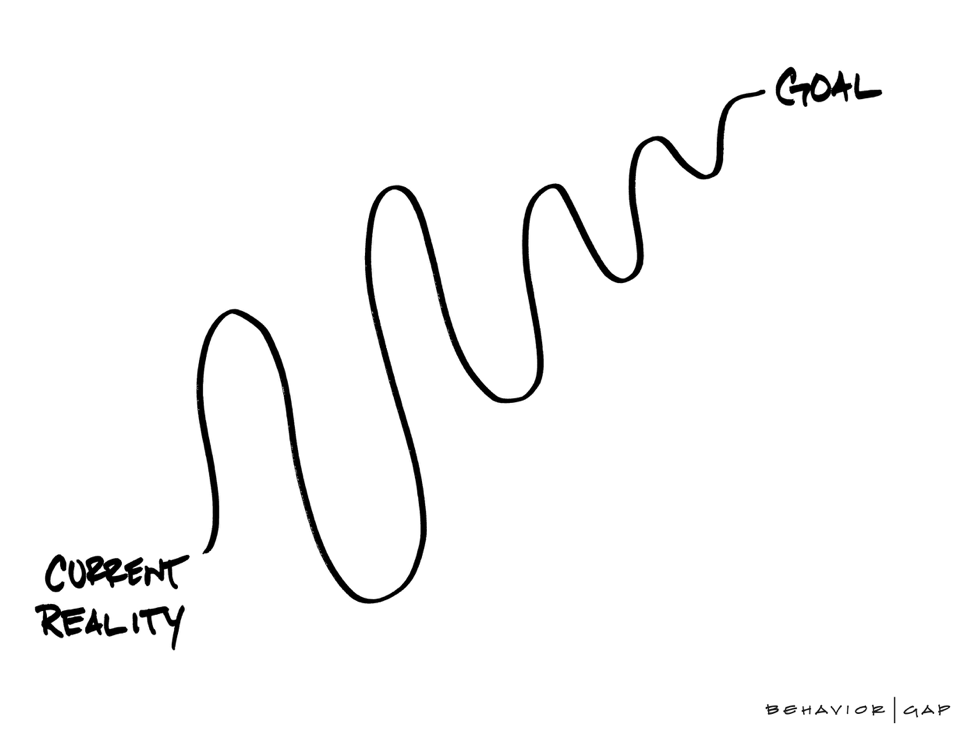

Find a Strategy that Works for You

Retirement planning would be easy if there were a safe investment vehicle, like a CD, that guaranteed 6% or 7% in interest. Then you could take what you needed and would allow the rest to compound over time.

But in reality, these types of investments don’t exist these days and it can be difficult to predict what today’s investments will yield tomorrow. Instead, it’s much more important to put together a retirement strategy that suits your income needs and cash flow specifically.

Partner with an Advisor who can Help You put it all Together

This leads to the most important factor in putting together a retirement savings plan that can put you in a position to work toward your retirement income needs: working with a financial professional who can help you find the pieces you need to put it all together. When you meet with a financial advisor for planning your retirement needs, you need to work with someone who spends time getting to know you before ever offering any specific advice.

At Puckett & Sturgill Financial Group, we take the time to get to know our clients in order to provide the ideal recommendations for each individual’s retirement planning needs. If you’d like to learn more about our personalized approach to retirement planning, contact us today to set up an initial meeting!

Schedule Your Free Consultation

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.